Searching for The Best Medicare Supplement Plans Available In Orange County, Florida?

We’ll guide you through the process to avoid some common mistakes when choosing your Medigap Plan

Choose From The Best Medicare Supplement Plans in Florida: Your Guide to Coverage

Are you a Florida senior searching for the best Medicare Supplement plans to fit your lifestyle? With 67 counties from the Panhandle to the Keys, finding Medicare Supplement insurance that works for you can feel like navigating a maze. But don’t worry! With nearly 30 years helping folks like you, I’m here to clear up the confusion, answer your top Medicare questions, and guide you to the right Medigap plan. Whether you’re soaking up the sun in Miami or enjoying the quiet life in Ocala, this guide covers Florida’s unique healthcare landscape, challenges finding Medicare-accepting doctors, and how I can help you get covered. Click Here To Compare All Plans

What's the process?

We’re easy to reach. Most use our form. This allows us to call you at the time of your convenience. We’ll ask about your Part B date, current coverage (if any), budget guardrails.

- Clear, Unbiased, Fast

- Licensed since 1994

- FL License #A169316

We shop carriers and identify underwriting flags (if any), Once we’ve identified several, we’ll contact you to set up the best time to go over our findings.

- No pushy sales theater

- Right-sized plan

- Application concierge

Right-sized Medigap plan (G, N, or fit) for your ZIP and budget

Application concierge (e-app done right, the first time)

Annual rate-check so you don’t overpay next renewal

- Same day quotes

- Apples-to-apples

- 24-hour response

Why This Site Exists

Medicare can be confusing, overwhelming, and unnecessarily noisy. For many people approaching age 65, it feels less like a healthcare decision and more like navigating a maze of conflicting advice, sales pressure, and generic information that rarely reflects where you actually live or how you actually retire.

MedicareSupplementsOnly.com was created to cut through that noise. Read more

2026 Medicare Costs at a Glance

$1,736.00

Part A Deductible (per benefit period)

$283.00

Part B Deductible (per year)

$202.90 (or higher depending on your income).

Part B Premium (The amount can change each year.)

$217

Skilled Nursing (days 21-100)

Varies

Medigap premiums by plan & location

What Is a Medicare Supplement Plan?

Medicare Supplement plans — often called Medigap — are optional policies you can buy from private insurance companies to help pay the costs that Original Medicare (Part A and Part B) doesn’t fully cover. Think of them as “gap fillers.”

With Medicare alone, you’re still on the hook for things like deductibles, coinsurance, and copays. A Medigap plan can step in and cover some or all of those out-of-pocket costs.

How Do They Work?

You stay enrolled in Original Medicare.

Medicare pays its share of approved healthcare costs.

Your Medigap plan pays its share after that.

You still use your red, white, and blue Medicare card at the doctor’s office — nothing changes there. The Supplement is just a backup, so you’re not left with big bills.

*Updated annually by Medicare. Premiums may vary based on income.

Fast Facts (Save Yourself Headaches)

- Medigap ≠ Advantage. Medigap works with Original Medicare; no networks, no referrals.

- Price is by ZIP/age/tobacco/household. Same benefits → different carrier rates.

- Timing matters. Your Part B date and Guaranteed Issue windows change underwriting.

- Doctor freedom. Any provider accepting Medicare. Traveling? You’re still covered.

Medigap vs. Advantage

- Medigap (We place it): higher premium, lower unpredictable costs, nationwide access, no network drama.

- Advantage (We don’t market it): lower premium, networks, authorizations, plan rules.

You want clarity, predictability, and freedom → Medigap usually wins.

What Drives Your Rate?

- ZIP code • Age (and birthday timing) • Tobacco status • Household discount • Carrier rate history

Why Florida Seniors Choose Medicare Supplements Only?

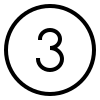

Nearly 30 Years of Experience

Chuck Lunsford has helped Florida residents navigate Medicare Supplement decisions since 1994. Licensed FL agent #A169316 with deep expertise across every Florida community—from Miami to the Panhandle.

Comprehensive Florida Coverage

We serve seniors in 50+ Florida communities with deep understanding of local healthcare landscapes and hospital access. Whether you’re in a bustling city or quiet rural town, we know your area’s unique challenges.

No-Pressure, Independent Guidance

We compare plans from multiple top-rated carriers to find the best value for YOUR situation—never locked into one company. Our educational approach means you make informed decisions at your own pace, with ongoing support after enrollment.

Which Plans Can You Choose?

Plans are standardized by letter — A through N — so a Plan G in Florida has the same benefits as a Plan G in any other state. The big differences are in monthly premium, underwriting rules, and which carriers sell it in your area.

The most popular in Florida today are Plan G (covers nearly everything except the Part B deductible) and Plan N (lower premium, but you pay a copay for office and ER visits). Click Here To Compare All Plans

Florida-Specific Notes

Community vs. Attained Age Rating: In Florida, most carriers use attained-age pricing — meaning your premium is based on the age you are when you enroll and can rise as you get older. That’s important to budget for.

Open Enrollment Window: You have a six-month guaranteed-issue period when you first enroll in Medicare Part B at age 65. After that, you may have to answer health questions to switch plans.

Household Discounts: Some Florida carriers offer a household or spousal discount if two people in the same household enroll.

Local Support: Since carriers and rates vary by county, we run quotes for your ZIP code to make sure you’re not overpaying.

What’s The Next Step?

If you’re turning 65 soon or already on Medicare and looking at options, we’ll compare every Medigap carrier available in your Florida county. You’ll see the actual premiums side by side, and we’ll walk you through how Plan G and Plan N stack up for your situation.

Top Medicare Supplement Plans in Orange County: Your Guide to Coverage

Welcome to your trusted guide for finding the perfect Medicare Supplement plan in Orange County, Florida. Whether you’re turning 65 or already navigating Medicare, I’m here to simplify the process and provide personalized, stress-free support. With nearly 30 years as a licensed insurance agent, I specialize in helping Orange County seniors find affordable Medigap plans tailored to their healthcare needs. From Orlando to Winter Park, I’ll ensure you have the coverage to enjoy your vibrant retirement in this dynamic Central Florida community. If any links in this guide don’t work, try the Medicare Care Compare tool or contact Orange County services for assistance.

Why Medigap Plans Are Gaining Popularity

Covers Out-of-Pocket Costs: Helps pay for deductibles, copayments, and coinsurance that Original Medicare doesn’t cover, reducing unexpected medical expenses.

Financial Security: Provides peace of mind and predictability by limiting out-of-pocket costs, especially during serious illness or lengthy hospital stays.

Nationwide Flexibility: Allows beneficiaries to see any doctor or specialist who accepts Medicare, with no need for referrals, ensuring broad access to care.

Guaranteed Renewability: Policies are renewable as long as premiums are paid, so coverage can’t be canceled due to age or health changes.

Variety of Plans: Offers a range of plan options to suit different healthcare needs and budgets, allowing individuals to choose the level of coverage that best fits them.

Emergency Foreign Travel Coverage: Some plans include coverage for emergencies abroad, appealing to retirees who travel internationally.

Stable Coverage Over Time: Ensures coverage remains reliable as healthcare needs evolve with age.

These benefits make Medigap an attractive option for many Medicare recipients.

What Makes Orange County A Great Place To Live?

Orange County, Florida, located in the heart of Central Florida, is a premier destination for retirees seeking an active, sunny lifestyle. With a population of approximately 1.4 million, this county is home to world-famous attractions, diverse communities, and endless recreational opportunities. A 65-year-old man or woman might enjoy exploring Lake Eola Park, visiting the Harry P. Leu Gardens, or attending cultural events in Winter Park. The annual Orlando Fringe Festival celebrates local arts, while Orange County Senior Services offers fitness programs, social clubs, and educational workshops for seniors. The county’s warm climate and robust healthcare system, as highlighted by the Florida Department of Health in Orange, make it a top choice for retirement.

Key cities and towns in Orange County with populations of 1,000 or more include:

- Orlando (pop. ~310,000): The county seat, known for theme parks like Walt Disney World and a vibrant downtown.

- Winter Park (pop. ~30,000): A charming city with historic charm, boutique shopping, and cultural attractions.

- Apopka (pop. ~57,000): A growing community with outdoor recreation at Lake Apopka.

- Winter Garden (pop. ~47,000): A family-friendly town with a bustling farmers market and historic downtown.

- Ocoee (pop. ~48,000): Known for its community events and proximity to healthcare facilities.

- Maitland (pop. ~19,000): A cultural hub with art centers and serene parks.

Orange County’s lively atmosphere and top-tier healthcare options make it an ideal place to retire. A Medicare Supplement plan can help you manage healthcare costs, letting you focus on enjoying your retirement.

Challenges Finding Medicare-Accepting Doctors and Hospitals in Orange County

Orange County boasts a world-class healthcare system with many providers accepting Medicare Assignment, where providers agree to the Medicare-approved amount as full payment, reducing your out-of-pocket costs. However, seniors aged 65 often face challenges like selecting the best providers for their specific health needs, managing healthcare expenses, and navigating the array of Medigap plan options. With Orange County’s large and diverse population, securing timely appointments with top specialists can be competitive, and understanding which plan offers the most value can feel daunting without expert guidance.

Key challenges include:

- Choosing the Right Providers: With countless doctors and hospitals, finding those specializing in your needs (e.g., cardiology, orthopedics, or geriatrics) can be overwhelming.

- Managing Costs: Even with Medicare, out-of-pocket expenses like copays and deductibles can add up, particularly for frequent medical visits.

- Understanding Plan Options: Deciding which Medigap plan best suits your active lifestyle and budget requires clear, personalized advice.

Closest Medical Facilities Accepting Medicare Assignment

To help you access healthcare in Orange County, I’ve outlined six top medical facilities and six providers accepting Medicare Assignment. Below are key facilities with estimated driving distances from central Orlando, the county seat and a central hub for healthcare access:

- AdventHealth Orlando

Located at 601 E Rollins St, Orlando, FL 32803, this hospital is just 2 miles from central Orlando, about a 5-minute drive. It offers comprehensive care, including cardiology and geriatrics, and accepts Medicare Assignment. - Orlando Health Orlando Regional Medical Center

Found at 52 W Underwood St, Orlando, FL 32806, this facility is approximately 3 miles from central Orlando, a 7-minute drive. It provides advanced surgical and emergency services, and accepts Medicare Assignment. - UF Health Central Florida

Located at 110 S Woodland St, Winter Park, FL 32789, this hospital is about 5 miles from Orlando, a 12-minute drive. It offers outpatient and specialty care, and accepts Medicare Assignment. - Dr. P. Phillips Hospital (Orlando Health)

Found at 9400 Turkey Lake Rd, Orlando, FL 32819, this facility is roughly 10 miles from central Orlando, a 20-minute drive. It provides emergency and surgical services, and accepts Medicare Assignment. - Health Central Hospital

Located at 10000 W Colonial Dr, Ocoee, FL 34761, this hospital is about 12 miles from Orlando, a 22-minute drive. It offers comprehensive care, including orthopedics, and accepts Medicare Assignment. - Winter Park Memorial Hospital (AdventHealth)

Found at 200 N Lakemont Ave, Winter Park, FL 32792, this facility is approximately 6 miles from Orlando, a 15-minute drive. It provides specialized outpatient services, and accepts Medicare Assignment.

Driving Distances to Key Facilities

Facility | Location | Distance from Orlando | Drive Time |

AdventHealth Orlando | Orlando, FL | 2 miles | 5 minutes |

Orlando Health ORMC | Orlando, FL | 3 miles | 7 minutes |

UF Health Central Florida | Winter Park, FL | 5 miles | 12 minutes |

Dr. P. Phillips Hospital | Orlando, FL | 10 miles | 20 minutes |

Health Central Hospital | Ocoee, FL | 12 miles | 22 minutes |

Winter Park Memorial Hospital | Winter Park, FL | 6 miles | 15 minutes |

Your decision doesn't have to be this overwhelming

We Help You Understand The Different Coverage Options and Gaps

An agent can explain what each plan offers, assess your healthcare needs, and identify which plan fills the gaps most effectively for you.

We'll Show You How To Compare Costs and Finding Affordable Plans On Your Own

An agent can shop around, compare quotes from multiple insurance companies, and help you find a plan that balances cost and coverage.

We'll Assist You In Figuring Out Enrollment Timing and Eligibility Rules

An agent can guide you through this timing, explain guaranteed-issue rights, and help avoid pitfalls like late enrollment penalties or medical underwriting if you switch plans later.

Directory of Medicare - Accepting Doctors in Orange County

Finding doctors who accept Medicare Assignment is key to minimizing costs and ensuring quality care. Below is a directory of six providers in Orange County, based on data from Florida Health Finder:

- Dr. Sarah L. Thompson, MD (Family Medicine)

Practice: Orlando Family Physicians, 1234 E Colonial Dr, Orlando, FL 32803

Accepts Medicare Assignment: Yes

Contact: (407) 894-1111

Services: Primary care, preventive services, chronic disease management. - Dr. Michael A. Carter, DO (Internal Medicine)

Practice: Winter Park Internal Medicine, 1964 N Orange Ave, Winter Park, FL 32789

Accepts Medicare Assignment: Yes

Contact: (407) 645-2222

Services: Internal medicine, geriatric care, wellness exams. - Dr. Robert J. Lee, MD (Cardiology)

Practice: Central Florida Cardiology Group, 1745 N Mills Ave, Orlando, FL 32803

Accepts Medicare Assignment: Yes

Contact: (407) 896-3333

Services: Cardiology, heart health, diagnostic testing. - Dr. Emily K. Nguyen, MD (Family Medicine)

Practice: Apopka Family Health Center, 225 E 7th St, Apopka, FL 32703

Accepts Medicare Assignment: Yes

Contact: (407) 889-4444

Services: Family practice, preventive care, chronic condition management. - Dr. David R. Patel, DO (Orthopedics)

Practice: Orlando Orthopaedic Center, 2501 N Orange Ave, Orlando, FL 32804

Accepts Medicare Assignment: Yes

Contact: (407) 423-5555

Services: Orthopedic care, joint replacement, arthritis management. - Dr. Lisa M. Chen, MD (Endocrinology)

Practice: Winter Park Endocrinology, 1573 N Mills Ave, Winter Park, FL 32789

Accepts Medicare Assignment: Yes

Contact: (407) 647-6666

Services: Endocrinology, diabetes management, thyroid care.

For a complete list, visit the Medicare Physician Compare tool and enter zip code 32801 for Orlando to find additional providers accepting Medicare Assignment. If this link is unavailable, contact the Florida Department of Health in Orange at (407) 858-1400.

Let’s face it, Medicare isn’t one-size fits all

Navigating Medicare can feel like wandering through a labyrinth of jargon, options, and fine print. I get it, clients often come to me feeling overwhelmed, unsure about coverage, costs, or whether they’re making the right choice. They worry about missing out on benefits or getting stuck with unexpected expenses. For nearly 30 years, I’ve listened to these concerns, answered countless questions, and helped demystify the process. My goal is simple: to understand your unique needs, clarify your options, and guide you toward a plan that brings peace of mind without the stress.

What We Offer - Expert Guidance to Your Perfect Supplement Plan

We’ll dive into your unique needs, simplify the maze of plan options, and guide you with clear, honest advice. My hands-on approach, backed by thousands of client success stories—ensures you get coverage that fits your life, stress-free.

Personalized Plan Comparison

We analyze your healthcare needs, budget, and preferences to recommend the best Medicare Supplement (Medigap) plans, clarifying coverage gaps like deductibles or copays that Original Medicare doesn’t cover

Expert Guidance Throughout

We simplify the complex enrollment process, ensuring clients meet deadlines, understand eligibility, and avoid penalties, while navigating them through plan options with clear, jargon-free explanations.

Ongoing Support and Advocacy

We offer continued assistance post-enrollment, helping with claims, plan changes, or unexpected issues, and stay updated on policy shifts to keep clients’ coverage aligned with their evolving needs.

F.A.Q.

You got questions? We got answers.

What is the best Medicare Supplement plan for Orange County residents?

The best plan depends on your healthcare needs and budget. Plan G offers comprehensive coverage, while High-Deductible Plan G is ideal for lower premiums. I’ll provide a personalized quote to match your needs.

How do I find doctors in Orange County who accept Medicare?

Use the Medicare Physician Compare tool for zip code 32801. I can also verify which providers accept your Medigap plan. If the tool is unavailable, contact the Florida Department of Health in Orange.

What are the benefits of a Medicare Supplement plan for active retirees?

Medigap plans cover out-of-pocket costs like copays and deductibles, ensuring affordable care so you can focus on activities like visiting Lake Eola or enjoying Winter Park’s cultural scene.

Can I switch Medicare Supplement plans if my needs change?

Yes, you can switch plans, though underwriting may apply outside your initial enrollment period. I’ll guide you through a seamless transition.

How do I get to medical facilities in Orange County?

For seniors needing transportation, Orange County’s LYNX transit system offers services to medical facilities in Orlando, Winter Park, and beyond.

How I Can Help You in Orange County?

With nearly 30 years as a licensed insurance agent, I’ve helped thousands of Florida seniors find affordable Medicare Supplement plans. Here’s how I make it easy for you:

- Custom Quotes: Compare plans like Plan G and High-Deductible Plan G to fit your budget and active lifestyle.

- Provider Matching: Connect you with top doctors and specialists in Orange County who accept your plan.

- Clear Answers: Simplify terms, like “Is Plan G worth the cost compared to Plan N?”

- Ongoing Support: Assist with enrollment, plan changes, and finding providers for your healthcare needs.

I understand that a 65-year-old retiree in Orange County wants to enjoy theme parks, lakefront walks, or cultural events without worrying about healthcare costs. My goal is to find you a Medigap plan that offers peace of mind, letting you focus on your retirement.

Addressing Your Pain Points

Seniors in Orange County prioritize staying active, managing healthcare costs, and accessing quality providers. I address these concerns by:

- Cost Management: I compare plans to find affordable options, like High-Deductible Plan G, which offers lower premiums for those comfortable with a higher deductible.

- Provider Access: I help you find doctors and hospitals, like AdventHealth Orlando, that align with your health needs, ensuring timely appointments.

Plan Clarity: I explain plan benefits in simple terms, helping you choose coverage that supports your active lifestyle and Original Medicare.

Conclusion

Choosing a Medicare Supplement plan in Orange County doesn’t have to be overwhelming. With my expertise, I’ll help you find Medicare-accepting providers, select a plan that fits your budget and active lifestyle, and navigate the healthcare system with confidence. Whether you’re in Orlando, Winter Park, or Apopka, I’m here to simplify the process and provide ongoing support. Contact me today for a free, personalized quote and take the first step toward peace of mind with your Medicare coverage.

Get Your Free Medicare Supplement Quote Today

Don’t miss your chance for the right Medicare Supplement plan. Call us at 1-239-633-4392, email info@medicaresupplementsonly.com, or fill out our form for a free consultation. Let’s make Medicare work for you. Learn more at the Centers for Medicare & Medicaid Services

Main Cities and Towns In Orange County

Alafaya, Apopka, Azalea Park, Bay Hill, Bay Lake, Belle Isle, Bithlo, Celebration, Christmas, Clarcona, Conway, Doctor Phillips, Eatonville, Edgewood, Fairview Shores, Forest City, Goldenrod, Fuller Heights, Gotha, Holden Heights, Holden Lakes, Horizon West, Hunters Creek, Lake Buena Vista, Lake Hart, Lake Mary Jane, Lockhart, Maitland, Meadow Woods, Oak Ridge, Oakland, Ocoee, Orlando, Orlovista, Paradise Heights, Pine Castle, Pine Hills, Rio Pinar, Sky Lake, Southchase, Taft, Tangelo Park, Tangerine, Union Park, University, Wedgefield, Williamsburg, Windermere, Winter Garden, Winter Park, Zellwood

Disclaimer:

MedicareSupplementsOnly.com is owned and operated by Charles “Chuck” Lunsford, a Life & Health insurance agent licensed in Florida (License A169316, active since 1994). Insurance product descriptions are for informational/marketing purposes only. The policy and any riders issued by the insurer contain the full terms, conditions, exclusions, and limitations. Eligibility, rates, and benefits are determined by the issuing carrier and are subject to underwriting and change.

We do not market Advantage plans. Not connected with or endorsed by the U.S. government or the federal Medicare program. This is a solicitation of insurance. Availability varies by area. Services available where licensed.

We specialize in Medicare Supplement (Medigap) insurance and related products.

This is a solicitation of insurance; a licensed agent may contact you. Products and services are available only where licensed. Availability and carrier participation vary by state and by product.

No tax or legal advice is provided. Consult your tax advisor or attorney regarding your specific situation. Email and text communications may not be fully secure; please avoid sending sensitive personal information unless requested through a secure channel. All trademarks and logos are the property of their respective owners.